Business Loans

"What do Underwriters and Banks actually Look at?"

September 28, 2020

BY DOUG WATERMAN

Content Contributor for The Company Doctors | Financial Advisor | Former Banking President

Underwritng - What does it really mean!

Underwriting simply means a lender verifies your income, assets, debt & property details in order to issue final approval for your loan.

An underwriter is a financial expert who looks at your finances & assesses how much risk a lender will take on if they give you a loan.

Four Key Loans where Businesses deal with Underwriters

Lines of Credit

Typically for one year,renewable annually.

Some are formula based (i.e.) xx% of Receivables + x% of approved inventory (called a borrowing base) - self certification

Some requirethat the loan be Cleaned up to a zero Balance at least 30 days during the year.

Subject to the wims and policy changes of the banks.

Lines of credit should be for ongoing shortfalls of working capital; always fund short term needs

If you're losing money, banks won't fund your Losses, except for very exceptional reasons.

Term Loans

Should fund long-term needs, i.e., equipment, capital improvements, permanent working capital needs & other long term needs.

Long term loans can run from 2 years to as long as 30 years for real estate; usually floating tied to Prime.

Governance is by loan agreement – will have loan covenants that must be met to prevent default – working capital,

debt coverage, leverage, financial statement requirements.

Balance sheet should reflect current portion of term loans (principal due one year) as well as long term portion of

long term loans – amount due to term.

Asset based loans

Lines of credit secured primarily by a percentage of eligible accounts receivables.

Eligible typically is any account that is outstanding for 90-days or less; some lenders may allow up to 120-days (exception).

Commercial bank do A/R financing (see short term loans above) & there are commercial finance companies that do A/R financing.

Finance companies often require that you send copies of all invoices and bills of lading showing product

has been shipped and the A/R has been created.

More expensive than commercial banks, with fees for document review and handling, but more flexible.

Finance (and some commercial banks) will conduct an annual audit of your books and accounts receivables.

Very few finance companies and commercial banks will lend against inventory; if so, typically against materials easily sold.

Factoring involves selling your accounts receivables to a factoring company; very expensive, heavy on fees, and

typically a hold back against payments from your customers.

SBA Loans

Section 504 loans are for real estate purchases and refinancing.

504 loans are typically 50% from a commercial bank, 40% from a CDC(Community Development Corp – nonprofit),

and 10% equity from the borrower.

Section 504 loans may have a fixed interest rate on the commercial lender’s portion (fixed for 3-5 years typically), and

fixed on the CDC portion.

Term can be up to 20-years.

Maximum amount is $14-million.

Section 7a loans are used for equipment and working capital, with maturities of up to 7-10 years.

Section 7a loans are also used for real estate acquisitions, at variable rates, up to 25 years, with at least 10% down (equity).

Maximum amount for 7a loans is $5-million.

Documentation is long and arduous; if the lender is a certified SBA lender, they can approve and fund the loans

without SBA approval, and the turn-around is fairly short; if not, and the SBA needs to review and approve, it can take

up to two or three months.

Financial Projections are Key for Underwriters

Why – demonstrate your ability to repay debt.

What – conservative, realistic, supported by historical performance.

How – know your business, weaknesses & strengths.

Pitfalls of doing a financial projections aggressive sales, unrealistic changes in COGS, inconsistent SG&A, Bal sheet

does not balance, NW does not reconcile.

The good news about financial projections – congratulations, you have a budget!

General Expectations of the Bank and Underwriter!

Personal guarantee of any 20% or more owner

3-years of company tax returns

If not filed in recent tax year, then internally prepared detailed financial statements

3-years of personal tax returns

Personal financial statement

1-year of company bank statements

Key items to focus on when preparing

Universal Cash Flow & What Is It & How Is It Calculated?

The Sum of Business cash Flow (EBITDA) = Net income + Interest expense + Taxes + Depreciation + Amortization

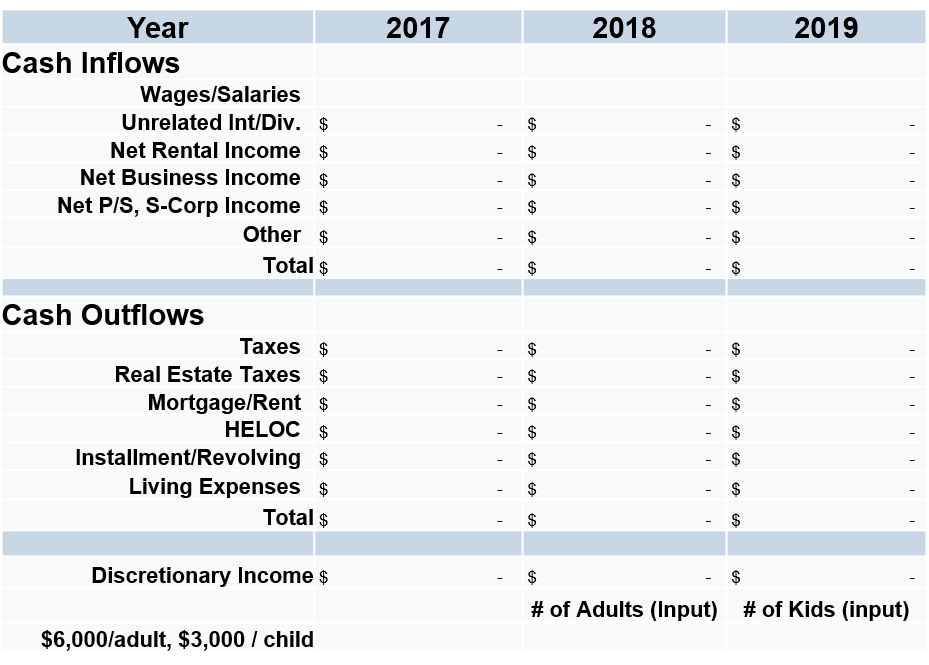

Calculating your Discretionary Personal Income

Personal income after income taxesLesshome mortgage or rent, installment

loan payments, credit card payments, other Plus: spouse’s income,

outside income, investment income

Example how to calculate>

Combined Cash Flow Calculation &

Debt Coverage Ratio

Example how to calculate>

Collateral – A Way to Reduce a Lender’s Risk

All the assets of the company and the cash proceeds

therefrom (sometimes called a “plaster lien”

Accounts Receivable – advances made against a % of the

outstanding A/R’s less allowances for bad debt

Equipment; always when financing new equipment

Real estate – commercial, investment and residential

Personal Guarantees

Lender may not require spousal guarantee,

However, If spouse is a 20% or more owner of the business, personal guarantee is required

If spouse’s portion of discretionary income is substantial, lender

may require a personal guarantee; should discuss with your

attorney

Guarantees today allow a lender to pursue both company assets &

personal assets of guarantor(s) simultaneously, not sequentially

Security Agreement and UCC-1 Filings

Document that defines the collateral that you agree to provide the lender

By making a UCC-1 Filing the lender records their rights as a holder of collateral with the State;

referred to as perfecting their collateral

Oftentimes borrowers discover that UCC-1 lien filings have not been removed when past loans are paid off;

need to do a UCC-1 search

Personal Credit - FICA Scores

Yes, even with great collateral, a high DCR, credit scores count

Lenders consider credit scores as a character indicator

Commercial bank score requirements are higher than most non-bank lenders

Before applying for a loan, pull your credit score and check for accuracy

Credit Karma is a good website to use

Prepare your Financial Statements

Have 3-yrs of tax returns

You should have the most recent balance sheet and income statement ready

Lenders want to see A/C Pay and Rec aging reports

Internally prepared or prepared by your accountant

Your Balance Sheet

Does it balance? Assets = Liabilities + Equity

Does Equity & Earnings reconcile?Current equity = Prev. yrs equity + current income

Do A/R & A/P aging balances agree with balance sheet entries?

Balance Sheet Ratios

Working Capital = Current Assets – Current Liabilities

Quick Ratio = Cash + A/R – Current Liabilities

A/R;A/P/Inv Days On Hand = How fast does it turn

Income Statement

(a.k.a. P&L Statement – Profit Statement – etc.)

Are income and costs consistent year to year?

How do you calculate material costs? (Beg Inv + Purchases – Ending Inv)

Is your Cost of Goods consistent year to year?

Are all direct costs included in COGS?

Are you making an Operating Profit?

OP = COGS – SG&A expenses (and before interest expense)

Are your SG&A expenses consistent.......Be prepared to explain spikes

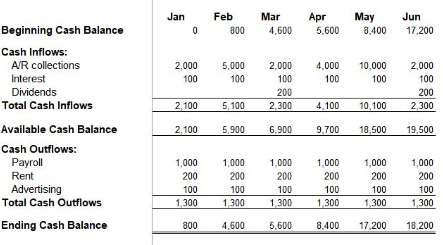

Cash Flow Statement

What and how is it created?

Scary? Look at your bank statement!

Keep in mind Financial statements use an accrual methodology

Cash flow statements are based on cash, in bank, in your drawer

Summary

Schedule a complimentary virtual review below and get prepared to close your loan!